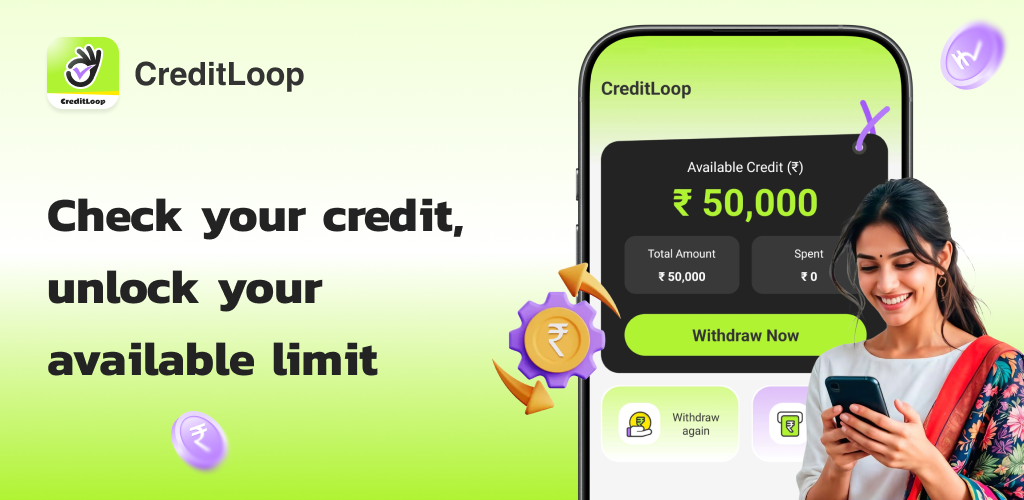

CreditLoop Revolving Credit

Based on credit assessment, withdraw cash anytime, anywhere, with flexible amounts!

Based on credit assessment, withdraw cash anytime, anywhere, with flexible amounts!

CreditLoop is not a traditional lending app, but a financial tool centered on credit limit assessment.

We use a big data risk control model to comprehensively analyze a user's identity information, consumption behavior, and historical credit records to assess the user's credit value and provide an available credit limit.

Unlike traditional loan apps, CreditLoop does not require users to borrow money from the outset. After completing the credit assessment and obtaining a credit limit, no fees are incurred if the user does not withdraw or use the funds. This is equivalent to reserving readily available backup funds for the user, rather than forcing debt.

Interest is only charged when the user chooses to withdraw and use the credit limit according to their needs. This "assess first, use later, pay as needed" model provides users with greater flexibility and security. CreditLoop is better suited to modern people's financial needs, helping users manage cash flow pressures when needed while avoiding unnecessary borrowing burdens and providing ample buffer space for personal financial management.

Comprehensive financial services designed to meet modern financial needs

Only identification is required for application.

Simple approval process.

Withdrawals as needed, flexible amounts.

Professional customer service team provides assistance.

Strict data encryption protects user privacy.

Equivalent to reserving readily available backup funds for users.

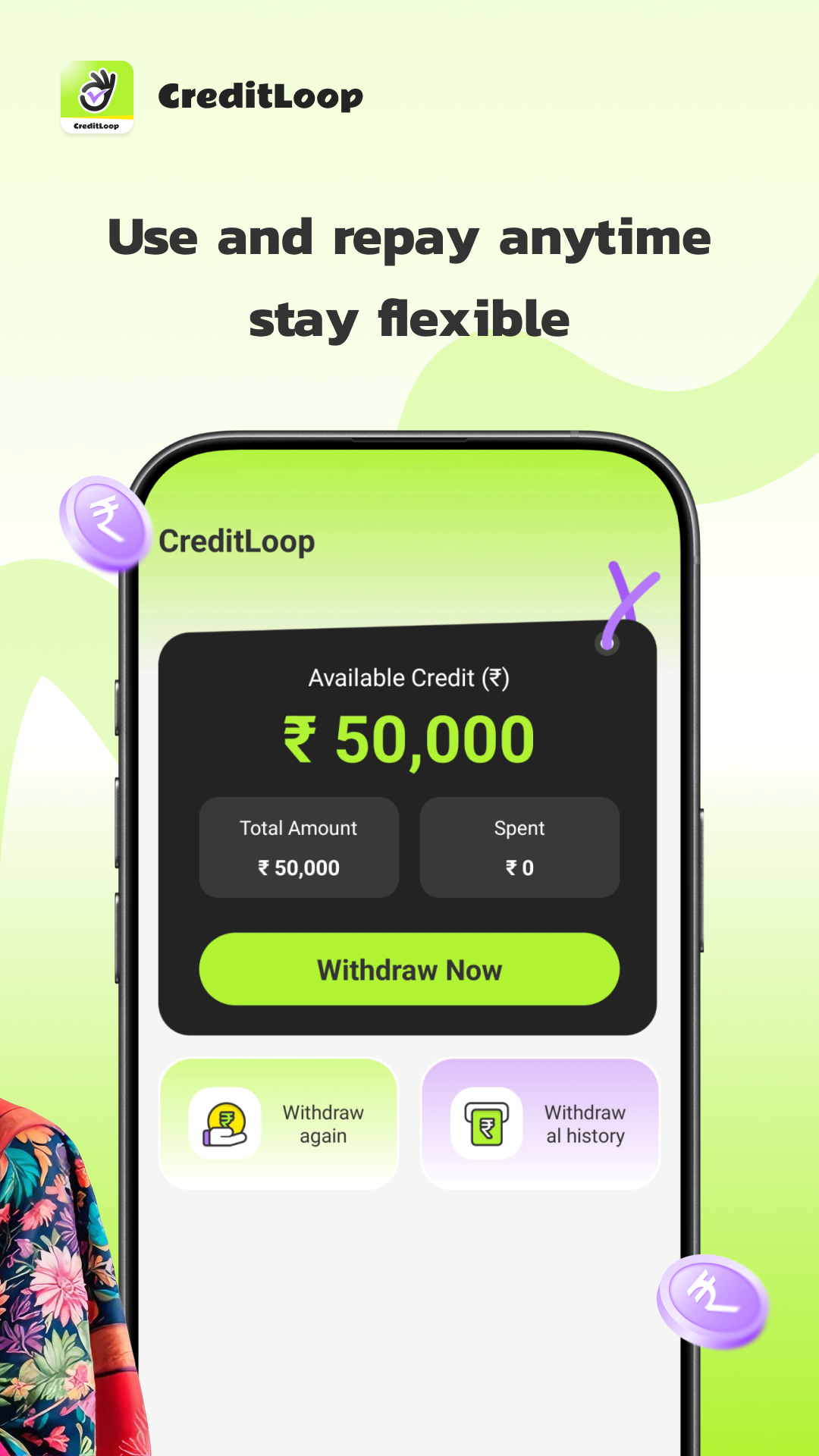

Flexible withdrawal periods and amounts to meet your financial needs

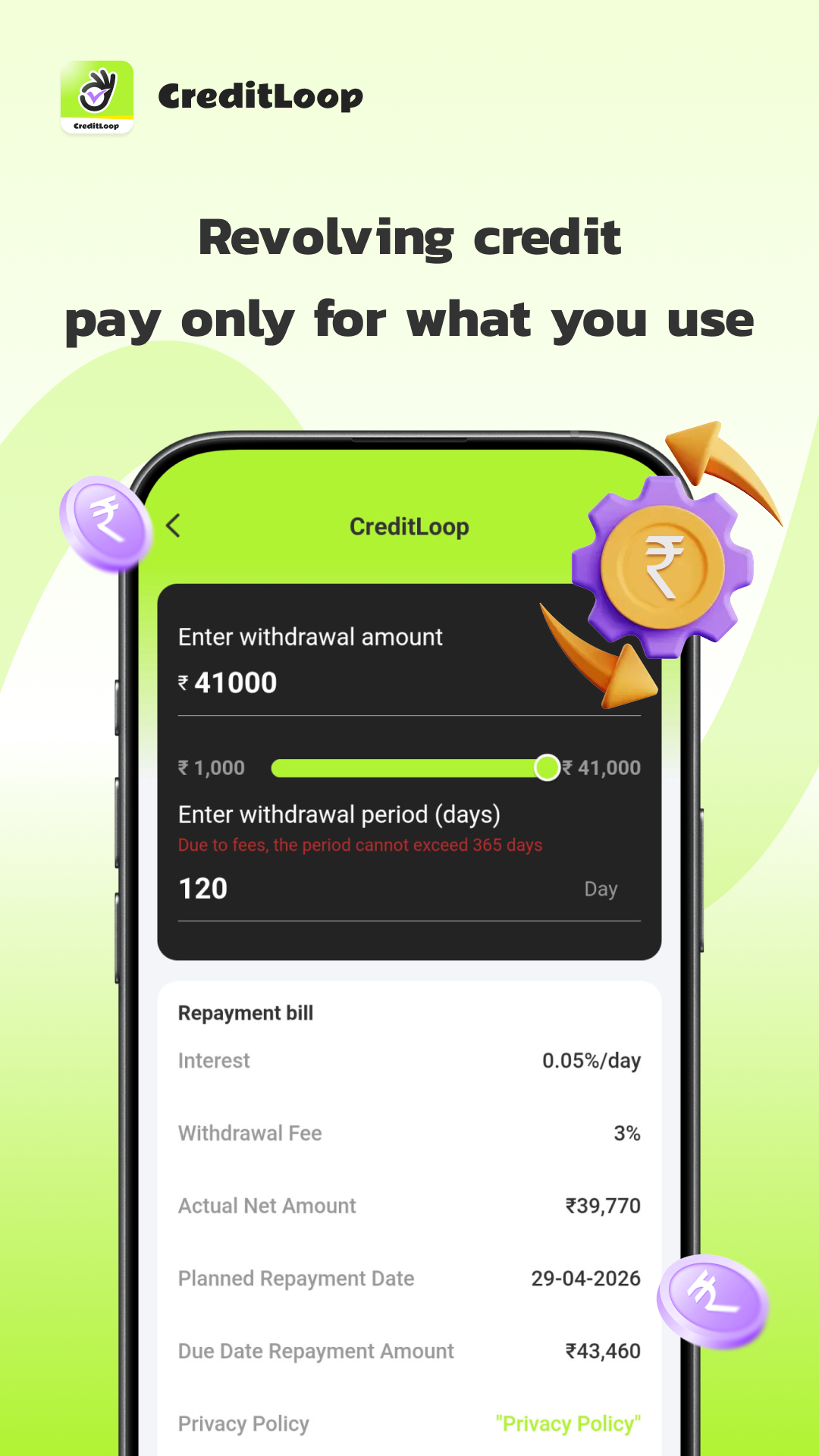

Flexible withdrawal period, users can choose themselves, with a maximum of 365 days.

Minimum 1,000 INR, Maximum 50,000 INR

Daily Interest: 0.05%/day, equivalent to a maximum of 18.25%/year

Withdrawal Fee: 3% of the withdrawal amount, charged for each withdrawal due to payment needs.

If the loan is not repaid by the due date, for example, if a user originally planned to withdraw for 30 days but needs to extend it to 45 days, the extra days will still be charged an extension fee of 0.05%/day.

Clear and transparent fee calculation for your understanding

Note: The user will receive a credit withdrawal amount of 9700 INR, which will be repaid in 120 days, amounting to 10,600 INR. If the user repays the amount early, the bill will be calculated based on the actual number of days the withdrawal was made.

Simple and clear application requirements

18 years of age or older (minors cannot apply)

Must hold a valid ID card